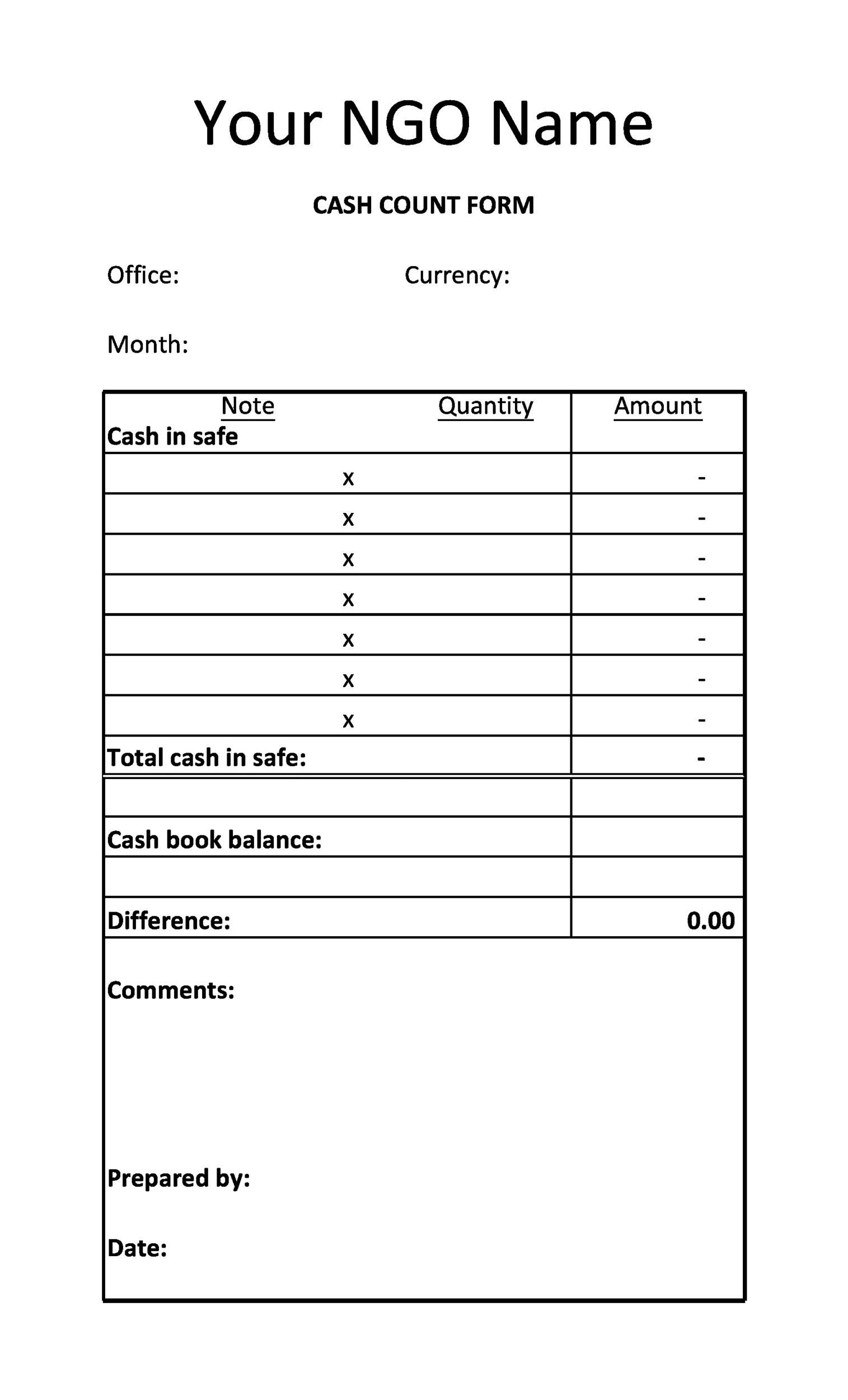

The debit balance as per the cash book refers to the deposits held in the bank, and is the credit balance as per the passbook. Some transactions first appear in a bank statement before they are entered into the cash book simply because the business is unaware of their existence until it receives the bank statement. Recall that the adjustments to the balance per BOOKS will require accounting entries for the items to be posted to the company’s general ledger accounts. If so, these entries will not appear in the bank reconciliation statement prepared at the end of the current month. Similarly, if a businessman deposits any checks on the last day of the month, these cheques may be collected by his bank and shown on his bank statement three or four days later.

Helps in managing accounts receivables

Any other items (such as NSF checks or collected notes) on the statement should be identified. After you have compared the deposits and withdrawals, determine any missing transactions. An asset account in a bank’s general ledger that indicates the amounts owed by borrowers to the bank as of a given date. More specifically, you’re looking to see if the “ending balance” of these two accounts are the same over a particular period (say, for the month of February).

- If any discrepancies cannot be identified and reconciled, it may signal an error or risk of fraud which your company can investigate further.

- Nevertheless, while bank errors are very rare, it is still a possibility.

- Whereas, credit balance as the cash book indicates an overdraft or the excess amount withdrawn from your bank account over the amount deposited.

- One is making a note in your cash book (faster to do, but less detailed), and the other is to prepare a bank reconciliation statement (takes longer, but more detailed).

- For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

Data entry error

Such errors are committed while recording the transactions in the cash book, so the balance as per the cash book will differ from the passbook. At times, the balance as per the cash book and passbook may differ due to an error committed by either the bank or an error in the cash book of your company. It is important to note that it takes a few days for the bank to clear the checks. This is especially common in cases where the check is deposited at a different bank branch than the one at which your account is maintained, which can lead to the difference between the balances. After adjusting all the above items, you’ll end up with the adjusted balance as per the cash book, which must match the balance as per the passbook. In addition to this, the reconciliation process also helps keep track the occurrence of fraud, which can help you control your business’ cash receipts and payments.

Improves Fraud and Error Detection

Today, online banking and accounting software offer real-time feeds and automated transaction matching. As a result, bank transactions can be automatically imported into an accounting software, where one is able to categorize and match a large number of transactions with one click of a button. This significantly 5 ways debt can make you money reduces the effort that goes into the reconciliation process and enables businesses to verify their cash balances anytime throughout the month. A bank reconciliation statement is a summary that shows the process of reconciling an organization’s bank account records with the bank statement.

We reference each entry as E, F, B, D, G, C, or K, as indicated on the right side of the bank reconciliation. Next, we will prepare a bank reconciliation for a hypothetical company by using transactions that are commonly encountered. While this will cause a discrepancy in balances at the end of the month, the difference will automatically correct itself once the bank collects the checks. Once you’ve identified the discrepancies, make any necessary adjustments. This step ensures your records accurately reflect your financial status. Generally, the responsibility for performing a bank reconciliation falls on an individual designated as the “bookkeeper” or accountant within the company.

Companies prepare bank reconciliation statements as a comprehensive accounting comparison tool. A company can ensure that all payments have been processed accurately by comparing their internal financial records against their bank account balance. Bank reconciliation statements are also important for alerting a company in case of fraud or error. To be effective, a bank reconciliation statement should include all transactions that impact a company’s financial accounts. Bank reconciliation is an important financial control process that helps ensure your financial records are accurate, and there are zero unexplained inconsistencies in your day-to-day transactions. Bank administrators process bank service fees, interest, and other bank transactions that you might not be aware of or not know the exact amounts of.

It is important that this person has a thorough understanding of accounting principles and procedures to be able to perform the task accurately and efficiently. For example, the payees may be contacted to determine if the checks have been misplaced. The $10,000 error is added because it understated the deposit and the account balance. The items in the bank section show that the bank’s version does not agree with the books because a deposit had not been processed and the checks had not yet been canceled. Service charges may be levied by the bank for regular or special services. They often appear as a reconciling item because banks notify customers of the amount only through the bank statement.

Likewise, ‘credit balance as per cash book’ is the same as ‘debit balance as per passbook’ means the withdrawals made by a company from a bank account exceed deposits made. NSF checks are an item to be reconciled when preparing the bank reconciliation statement, because when you deposit a check, often it has already been cleared by the bank. But this is not the case as the bank does not clear an NFS check, and as a result, the cash on hand balance gets reduced. The balance recorded in the passbook or the bank statement must match the balance reflected in the customer’s cash book. It is up to you, the customer, to reconcile the cash book with the bank statement and report any errors to the bank.

Outstanding checks (also known as unpresented checks or uncleared checks) are the checks that have been issued by the depositor in favor of a creditor but have not yet been presented for payment by him. The amount of these checks are recorded by the depositor when they are issued but no entry is made by the bank in his account until the checks are actually presented and payment received by the creditor. Unpresented checks, therefore, cause a difference between the balance in company’s accounting record and the balance as per bank statement for the period concerned.